Even if they are not bringing in a profit, they still want their rent to be taken care of and employee salaries to be paid. In a worst-case scenario, a company would want to make sure that they could at least cover their expenses. Break-Even Point Analysisīreak-even point is an analytic tool that helps businesses to understand what their lowest margin of growth should be. In his break-even analysis, Erick would want to determine the margin beyond that number where he would feel comfortable having his lowest total of products sold while still generating a profit. So any result with a decimal would need to be rounded up to the nearest whole number.įor Erick’s business, he would need to sell at least 105 pairs of sunglasses per year in order to break even. In this case, the break-even point would be 104.89.Īs an important note, in break-even analysis, you cannot have a partial sale. It also allows managers to understand the required turnover and work needed in order to remain beyond that safety zone.

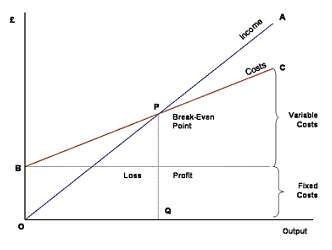

The break-even analysis examines what the safe distance is from that point that will allow the company to grow.īy comparing the amount of revenue or units that need to be sold to cover fixed and variable costs, break-even point analysis calculates the margin of safety that a company has. However, results above the break-even point mean the company would be generating a profit in varying degrees. While they wouldn’t be making any money, all their costs would still be covered.īelow that point, the business would not even be generating enough to cover their expenses. At the “break-even point,” a company would not be making a profit, but they also wouldn’t be experiencing any losses. In other words, it is the amount sales can decrease before a company reaches the break-even level of output and fails to make a profit.Break-even point analysis examines how much a company can safely stand to lose before descending below its break-even point. It considers the number of units produced and the number of units that need to be produced in order to achieve the break-even level of output. The margin of safety is the difference between the current level of output and the breakeven level of output. This means that company E has to produce 9 e-bikes a month to reach the break-even level. The point where the revenue and total costs lines cross is the break-even level of output. Lastly, we have to plot revenue according to the number of units produced (R). Then, adding them together, we arrive at total costs (TC). To create a break-even chart (see Figure 1), we need to plot both fixed costs (FC) and variable costs (VC). How many e-bikes per month does the company have to produce and sell to reach the break-even level of output?įig. The cost of materials per e-bike is £400. A rental cost of a factory is £8,000 a month and the cost of heat and light there is £6,000 a month.

It is the selling price minus variable costs.Ĭompany E produces e-bikes.

Total costs are fixed costs and variable costs added together.Ĭontribution per unit is total revenue from the sale of one unit. Variable costs are costs that rise and fall in direct proportion to the number of units produced, for example, raw materials used in production or direct labour. There are two ways to calculate the break-even level of output:ġ) Formula: B r e a k e v e n = t o t a l f i x e d cos t s c o n t i b u t i o n p e r u n i tĢ) Break-even chart (including variable costs, fixed costs, total costs and revenue)įixed costs are costs that remain the same (in the short term) regardless of the number of units produced, for example, rent and rates.

#Finance break even point formula how to#

How to calculate the break-even level of output? To conduct the break-even analysis, it is essential to calculate the break-even level of output. When a business achieves a break-even level of output and sales, it recovers all of its costs. Lifestyle and Technological Environmentīreak-even analysis, in other words, cost-volume-profit analysis indicates how many units the firm has to produce and sell before it recovers its total costs.Business Considerations from Globalisation.

Risks and Rewards of Running a Business.Evaluating Business Success Based on Objectives.Information and Communication Technology in Business.Effects of Interest Rates on Businesses.Improving Employer - Employee Relations.

0 kommentar(er)

0 kommentar(er)